Verified

4

Rating

12 MB

Download Size

13 MB

Install Size

About App

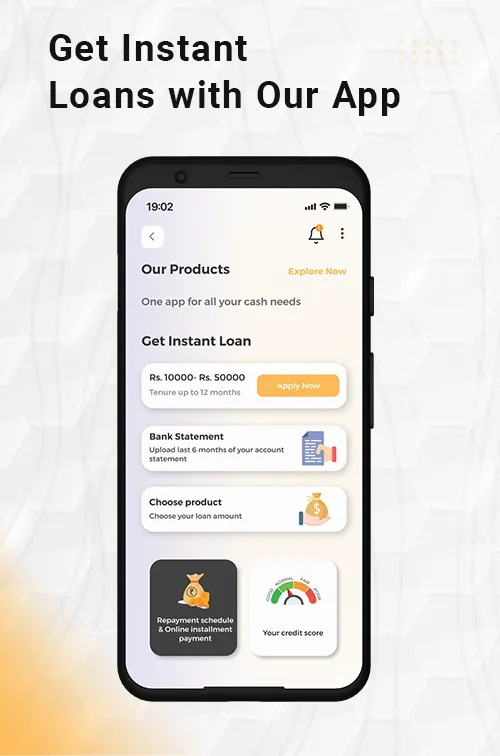

Welcome to Dhanrashi! Our user-friendly platform offers a range of financial services designed to meet your everyday Financial needs. Dhanrashi is enabling Credit for micro enterprises in rural and semi urban India.

At Dhanrashi we understand the importance of security and privacy, which is why our platform uses the latest encryption technology to keep your data safe and secure. Our app is also compliant with all applicable laws and regulations, giving you peace of mind when it comes to your finances.

How It’s Work

All Customer Sourcing is Through Dhanrashi mobile app, available at play store where customer can download the App or Assisted model; on boarding done by Dhanrashi branch staff.

• Phy-gital presence – 48 cities

• Referral code based - Simple Online Registration

• Easy And quick Verification

• Swift Disbursements

Highlights

Loan Amount- Upto 1,00,000

Loan Tenure- 2 Months to 24 Months

Maximum Annual Percentage Rate (APR) - 43%-122%

Processing Fee - 2%-4%

Other Charges Like Collection, Convenience & Platform fee - 2%-6%

Minimum period of repayment- 2 months

Maximum period of repayment-24 months

Maximum Annual Percentage Rate (APR): 122%

Product Example (Personal Loan)

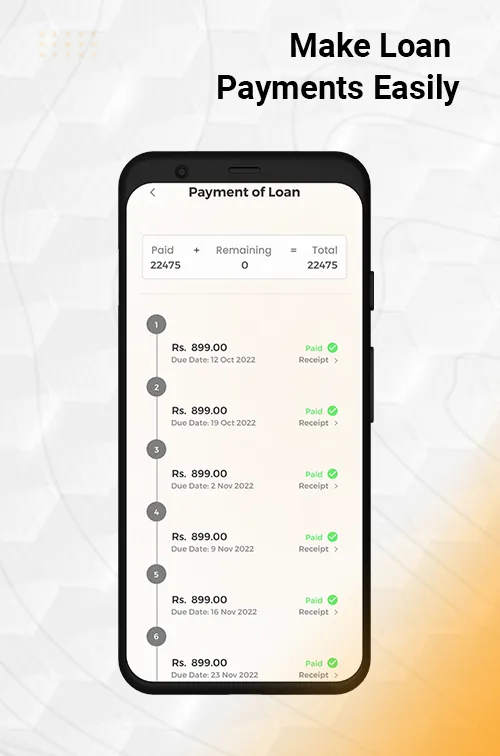

• Loan amount – 25,000

• Tenure – 6 months

• Total Instalment -25

• Rate of Interest - 3% Per Monthly.

• Processing/Verification Fee – 1000/-

• Total Payable Interest – 4438/-.

• Instalment(Weekly) –1250/-

• Maximum Annual Percentage Rate (APR) – 59%

• Total Payable:- 31250/-

• Disbursed amount – 22501/-.

• *Other Charges Like Collection, Convenience & Platform fee– 1812/-(120 Per Instalment

• **Insurance & Hospicash (Third Party Product) - 1499/-

Note- 1. Above mention data are representative, data may vary According to

Borrower Credit History and Product.

2. *Other charges are instalment component, which will deduct from

per

instalment collection

3. **Insurance & Hospicash are Third Party Product, they are not part of loan

product.

4. All charges GST Inclusive.

Dhanrashi has partnered with RBI approved NBFC’s

1. Maxemo Capital Services Pvt. Ltd Website - https://maxemocapital.com/

2. Salora Capital Limited Website - http://saloracapital.com/

3. Sawalsha Leasing And Finance Private Limited Website - https://sawalsha.com

4. Arthmate Financing India Private Limited Website -https://www.arthmate.com/

Safety and Security

Dhanrashi Fintech Private Limited top priority is security and safety of data, so we use 256 Bit encryption for Data Management.

For Easy and quick process, we require the following app permission-

Location Access

To Check the Serviceability of a Loan Application

Camera, Media ,Storage Access

To Upload Selfie and KYC Doc’s

Terms of Use-https://dhanrashi.in/term-condition.php

Privacy Policy -https://dhanrashi.in/privacy-policy.php

Contacts

Toll Free- 18001203050

Mobile No. 0124-428427

Email- [email protected]

Developer Infomation

Safety starts with understanding how developers collect and share your data. The developer provided this information and may update it over time.

Email :